Financial Stability

Patricia

In addition to housing, transportation, and food, Patricia’s major expenses include utilities, clothing, and household upkeep. She also believes in tithing (i.e., giving a percentage of her income) to her church. She is in relatively good health and receives Medicare benefits, but she covers some of the cost of the prescription drug she takes for high blood pressure. Although Patricia’s income is more than $2,000 below the Asset Limited, Income Constrained, Employed (ALICE) “survival budget” of $33,372—i.e., the estimated income needed to meet basic needs for a person in her demographic group—she struggles to make ends meet and feels the pinch, especially during the holiday season. She likes to splurge on gifts for her children and grandchildren at Christmas. But two new tires for her car depleted all the money she had budgeted for gifts last year, which forced her to reduce her spending and dip into savings. Given her relatively low retirement nest egg—and the fact that she usually has little to no money left over to add to it—she worries about how she will make ends meet if her car repair, healthcare, and other costs increase. An added worry is that her current spending levels depend on her part-time job as a library assistant. If and when she can no longer earn that supplemental income, it will likely mean significant lifestyle adjustments—giving up her car, most likely, as well as finding lower-cost housing.

Financial Stability

Financial stability is crucial for older adults to maintain a decent quality of life, age in place, and access critical resources. Whether an older adult is financially stable is influenced by life experiences and other characteristics. This section of the report assesses financial stability, including poverty levels, household income, basic living expenses, and the financial experiences of older adults in Central Indiana.

- All three older adult age groups experienced significant increases in income between 2015 and 2021.

- Overall, one in 12 older adults experiences poverty, with poverty rates similar between older adults in Central Indiana and Indiana as a whole.

- Black and Latinx older adults are more likely to experience poverty than White older adults, and older women are more likely to experience poverty than older men.

- Nearly one fifth of adults of traditional retirement age continue to work outside the home.

- Healthcare and housing are the costliest expenses for older adults in Central Indiana.

- Over two in five older adults reported recently experiencing at least some difficulty affording daily expenses or finding affordable health insurance.

- In general, Central Indiana is like Indiana as a whole in many measures of financial stability, but there are some notable differences, such as a greater percentage of older adults in Central Indiana paying over 30 percent of their income on housing costs.

- Among older adults (age 55+) in Central Indiana, as age increases, income generally decreases.

Income typically decreases as households age.

2021 Median household income for each age group (Central Indiana).

Income has increased across all older adult age groups in Central Indiana since 2015.

While the median household income (MHI) of older adults has increased over time, it is important to determine whether those increases have kept up with inflation. That is, do older adults have the same buying power now that they had in the past? Inflation seems to have peaked in mid-to-late 2022. When comparing the MHI of older adults in 2015 and 2021, it appears that the growth in MHI across all three older adult age groups for Central Indiana surpassed the inflation rate, as determined by the consumer price index. For example, the MHI for the 55-64 age group in 2015 was $60,000, which equates to $70,725 in 2021 dollars, while the actual MHI for this age group in 2021 was $74,010, indicating that they have slightly higher incomes on average than in 2015. There is a similar trend for the 65-84 age group, whose 2021 actual MHI ($54,000) is higher than their inflation-adjusted 2015 MHI ($49,696), and for the age 85+ age group, whose 2021 actual MHI ($38,200) is higher than their inflation-adjusted 2015 MHI ($34,655). This suggests that the MHI of older adults has kept up with, and even slightly surpassed, inflation since 2015.

MEDIAN HOUSEHOLD INCOME AND POVERTY

Household income includes sources such as wages from employment, retirement income, Social Security income Supplemental Security Income, and other public assistance payments.1 2 Among older adults in Central Indiana, median household income varies by age group – as age increases, income generally decreases. In 2021, the median household income of younger-old adults was $74,010.3 At approximate retirement age, that income declines to $54,000 for the middle-old. A further decrease occurs when the older adult population reaches age 85 and older, when median household income declines to $38,200.4 5

Overall, between 2015 and 2021, the median household income of older adults (55+) in Central Indiana increased, from about $47,000 to $60,000. All three age groups experienced significant gains in median household income between 2015 and 2020. However, not all populations were equally impacted by these gains. For example, while White and Black older adult households achieved significant increases in median income from 2015-2021 (over 20 percent increase), the income gains experienced in Latinx households were not statistically significant. This is the pattern seen throughout the state.

Poverty and financial insecurity are a challenge for older adults on a fixed income. According to the U.S. Census official poverty measure, Central Indiana has lower poverty among older adults than both Indiana and the nation. However, the official poverty measure underestimates poverty among older adults. Additionally, it does not consider public assistance programs that are not accessible to all people, e.g., younger-old adults have fewer resources available to them until they are eligible for benefits like Medicare and in most cases, social security.6 The supplemental poverty measure has been consistently higher than the official poverty measure for older adults (age 65 and older) across the U.S. Until 2020, there was almost a four-point gap between the supplemental and official poverty measures. In 2020 and 2021, that difference shrank to less than one percentage point, due in part to federally enacted pandemic relief policies.

Specifically, nationwide, the supplemental poverty rate fell significantly for all ages in 2020, due to pandemic-era cash assistance programs from the federal government. In 2021, the expanded Child Tax Credit in the American Recovery Plan Act reduced child poverty by about half. Working age adults also benefited from the Child Tax Credit payments. As these programs ended, poverty in all these groups rose significantly, with those 65 and older experiencing over 14 percent supplemental poverty rates in 2022.

Focus groups of older adults reported experiencing poverty throughout their lives and continuing to lack financial stability, despite years of employment.7 Key informant service providers discussed difficulty and low success rates employing those who continue to experience poverty.8 This suggests that if poverty rates are high among younger-old adults while many are still employed, they may not be able to improve their incomes when or if they retire.

In Central Indiana, according to the official poverty measure, gender disparities also exist among older adults experiencing poverty. Older women (55+) experienced higher poverty rates than older men in 2021, at 8.9 percent versus 7.2 percent, respectively. This disparity exists throughout Indiana as well, where the poverty rate is 9.6 percent for older women and 7.4 percent for older men.

There also are stark racial disparities among older adults experiencing poverty. According to the official poverty measure, between 2017 and 2021, the poverty rate among all older adults (55+) in Central Indiana was 8.1 percent. However, Black older adults (17.7 percent) and Latinx older adults (11.6 percent) experienced significantly greater poverty rates than White older adults (6.4 percent).

These trends also hold true throughout Indiana as a whole. Households are housing-cost burdened when they spend more than 30 percent of their income on housing-related costs.9 For more on housing and housing costs, please see the Housing section of this report. To learn more about some of the factors that influence higher poverty rates among Black older adults, please read “Highlighting Equity” below.

Poverty in Central Indiana for older adults is like that in Indiana, and has changed little since 2015, except for the oldest population, which experienced increased poverty.

Changes in poverty rate from 2015-2021 (official poverty measure).

Supplemental Poverty for older adults is greater than the official poverty measure.

Nationally, supplementary poverty rates increased among people age 65+ between 2020 and 2021.

The official poverty rate for Black older adults is almost triple that of White older adults in Central Indiana, with Hispanic poverty almost double that of White older adults.

Poverty rate for individuals age 55 or older by race and gender, 2017-2021.

Disparities in Incomes and Wealth

Organizational factors

Black workers are paid less than their White counterparts

The 2022 American Community Survey (one-year average) found that Black workers in Indiana earned 78 cents for every dollar earned by White workers in the state.10 Additionally, a national sample of 1.8 million employees between 2017 and 2019 found that Black workers continue to have lower earnings than White workers even when possessing the same level of education and experience.11 Because of this disparity in pay and discretionary income, it is difficult for Black adults to save and accumulate wealth over their lifetimes.12

Social Security benefit amounts are lower for Black Americans due to lower lifetime earnings

Because Social Security benefits are based on income, and Black workers earn less than their White counterparts, Black older adults tend to receive less income through Social Security when they reach retirement age ($22,200 vs $18,600).13 Social Security is the only source of income for roughly one third of American Black older adults, compared to 18 percent of White older adults.14 As workers approach retirement age (51-64 years), the median value of White vs Black middle-income earner’s retirement accounts are substantially different: $93k vs $35k. 15

Community factors: Black adults are less likely to own their homes

In the United States, homeownership is an important avenue for building wealth.16 However, in response to the Federal Home Loan Bank Board in the 1930s, mortgage lenders and banks started to deny access to credit to purchase a house in majority-Black and low-income immigrant neighborhoods, as these areas were deemed to be “hazardous“ for investment processes. As a result of these practices and other financial inequalities, Black adults are half as likely to own their own homes (39 percent vs 75 percent in 2021), and thus have less equity and wealth to pass on to their heirs.17 In 2022, the median net worth of a U.S. White family with a head of household age 55 and older was $333,000, nearly five times greater than that of the median Black family in the same age group, $68,000.18

Policy factors: Federal policies limited Black workers’ opportunities

The National Labor Relations Act of 1935 allowed the federal government to endorse union groups that excluded Black workers from membership. This policy affected the ability of Black workers to obtain blue-collar jobs, further exacerbating the income and wealth gap.19 20

Income Sources

Employment

Employment opportunities are crucial to the financial stability of many older adults, as well as contributing to the labor needs of Central Indiana. Adults age 55 and older make up 22 percent of the total workforce.21 On average, 20 percent of older adults in Central Indiana participate in the labor force beyond the traditional retirement age of 65, with Hamilton County having the highest percent (23.5 percent), and Johnson having the lowest (16.5 percent).22 After age 65, of those in Central Indiana who continued to work, just over half (51 percent) worked full-time (at least 35 hours per week), while another third (36 percent) worked at least 15 hours per week.23

While some older adults continue to work after retirement because they need the income, according to focus group participants, others continue to work because they enjoy their jobs or do not know what they would do after retirement. Others maintain employment because of the benefits, including health insurance coverage. Private health insurance enables access to health care providers who do not accept Medicare. Nationally, since the pandemic, older adults are leaving the workforce at significantly higher rates than other age groups. Particularly older adults with a college education left the labor force almost three-times the average rate of other groups (-2.6 vs -0.9), relative to pre-pandemic labor force participation rates. 24 As seen in the unemployment graph, the Indiana Department of Workforce Development reports a dramatic decline in unemployment claims since the pandemic, across all counties in Central Indiana.25

At nearly three-quarters (71 percent), Marion County has the greatest proportion of older adults (55+) who work in the same county where they live, while less than one quarter of older adults who live in Hancock & Morgan County also work there (both 22 percent).26

Social Security and Supplemental Security Income

Many older adults of retirement age depend on social security benefits to survive when they are no longer working or are earning limited amounts. In 2021, 51.8 percent of older adults in Central Indiana received social security benefits, slightly less than the state (55.6 percent).27 Among the younger-old in Central Indiana, 14 percent are receiving social security benefits; this number increases to 86 percent for the middle-old, and 90 percent for the oldest-old.

Adults age 65 and older or who have a disability, and especially limited incomes may be eligible to receive an additional federal benefit – Supplemental Security Income (SSI) cash benefits to assist them with affording their basic needs.28 Like the state of Indiana, in 2021, about four percent of older adults in Central Indiana received SSI benefits. The proportion of younger-old who receive SSI (4.0 percent) in Central Indiana is slightly higher than the middle-old and the oldest-old (3.2 percent and 3.9 percent, respectively). Older Black adults in Central Indiana are more than twice as likely to need SSI benefits compared to Whites (8.0 percent vs 3.0 percent), with Hispanic older adults least likely to receive this benefit (2.0 percent). The standard monthly SSI payment of $914 per individual and $1,371 per couple in 2022 is reduced based on other income. In Central Indiana there are over 8,000 older adults (65+ years) with a diagnosed disability who might qualify for SSI currently in the workforce, and almost 10 percent of those are unable to find work.29

The percentage of the population in Central Indiana receiving social security benefits is similar to Indiana as a whole, with some subtle differences between age groups.

Percent of the population receiving supplemental security income (SSI) as a percent of the age group population.

One-fifth of workers are older adults.

Navigating Poverty and Financial Instability

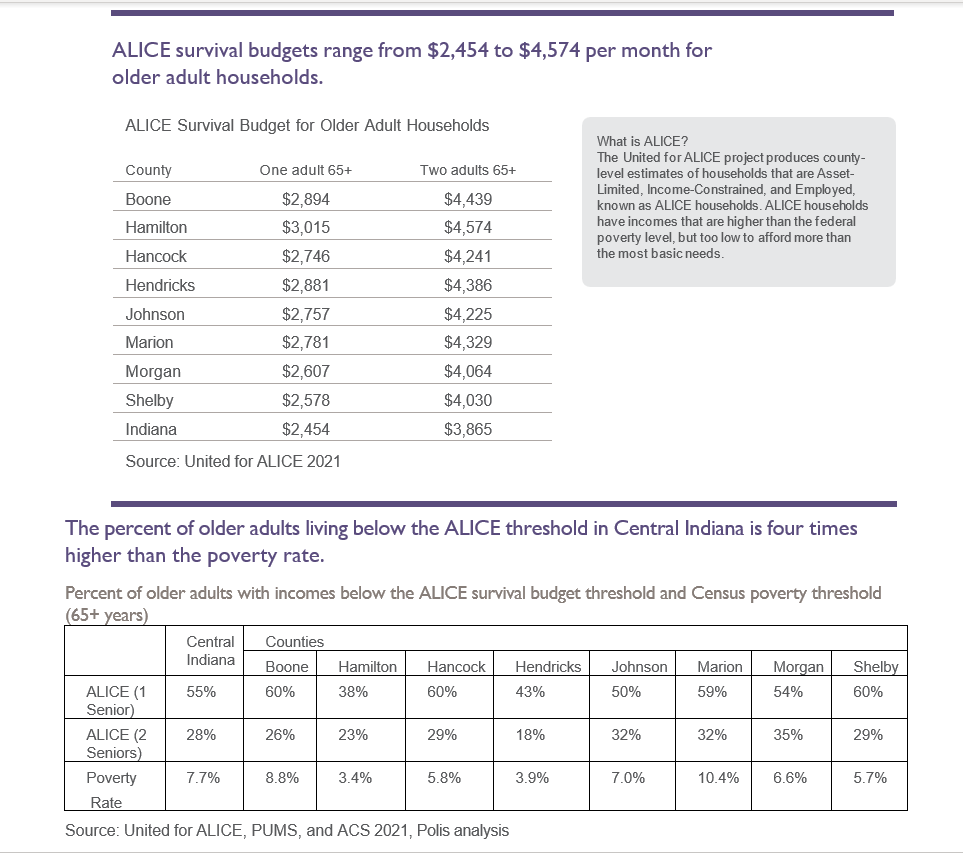

Insufficient income and poverty are not the only concerns facing older adults in Central Indiana; managing that income considering household and other important expenses is also a consideration. The United for ALICE project produces county-level estimates of households that are Asset-Limited, Income-Constrained, and Employed, known as ALICE households. ALICE households have incomes that are higher than the federal poverty level, but too low to afford more than the most basic needs. In Central Indiana, there are an estimated 13,000 adults (9 percent) age 65 and older who experience poverty, and more than 55,000 (37 percent) whose incomes fall below the ALICE threshold.30

The “survival” or most basic budget of an older adult ALICE household depends on whether it is a household consisting of an older adult living alone, or two older adults (both without children). In both cases, the budget is based upon county-specific expenses for housing, food, transportation, health care, technology, taxes and miscellaneous items. In Central Indiana, Hamilton County has the highest ALICE monthly survival budget for older adults, at $3,015 for single-adult and $4,574 for two-adult households. Meanwhile, Shelby County has the lowest ALICE survival budget for older adults, at $2,574 and $4,030. These budgets are both higher than the Indiana budget, which is $2,454 for a single older adult, and $3,865 for two older adults. Every Central Indiana county has a higher monthly ALICE survival budget than the state of Indiana overall.

The largest expenses for older adult households are housing and health care. Monthly ALICE housing costs are greatest in Hamilton County at $791 and $849for one- and two-older adult households, respectively, while they are the lowest in Shelby County, at $542 for both one and two-older adult households. Monthly health care costs are greatest in Marion County, at $560 and $1,120 for one- and two-adult households, respectively, while they are lowest in Johnson County, at $499 and $998. More detail on county-specific expenses may be found in the data appendix, located here

Impact of Housing Costs on Financial Stability

Because of a relatively high cost proportional to the typical household budget, housing and related costs can place a great deal of financial stress on older adult households. When 30 percent or more of its income is spent on housing costs, a household is considered housing-cost burdened. When 50 percent or more of its income is spent on housing costs, a household is considered severely housing-cost burdened.31 In Central Indiana for 2021, 16 percent of the younger-old were housing cost-burdened, 28 percent of the middle-old and 33 percent of the oldest-old.32 For older adults overall, this represents a modest decline since 2014, dropping from 29 percent to 26 percent in Central Indiana. Eleven percent of the younger-old were severely housing-cost burdened, 12 percent of the middle-old and 33 percent of the oldest-old. The overall proportion of older adult households who are severely housing-cost burdened changed little from 2015 to 2021. Older adults who rent are almost three times more likely to be housing cost-burdened than those who own their homes. For more on housing costs and challenges affecting older adults, please refer to the Housing section of this report.

Needs Faced by Older Adults

In Central Indiana, over two in five (41 percent) of respondents to the Community Assessment Survey for Older Adults age 60 and older (CASOA) reported that finding affordable health insurance was at least a minor problem over the past year, an improvement of nine percentage points since 2017.33 34 35Older adults participating in focus groups across the Central Indiana region also voiced concern about their ability to afford healthcare. To qualify for Medicare, an individual must be 65 years old, unless they are a dialysis patient or have a qualifying disability.36 The younger-old may try to access Medicaid but may not qualify based on income. Adults from this age group express frustration that qualification for Medicaid is based on gross income rather than net income, resulting in disqualification for some patients who would otherwise qualify.37

Though all older adults who participated in focus groups alluded to finances, those with lower incomes consistently identified healthcare coverage as an issue. In addition to healthcare, specific financial management concerns involved balancing expenses such as housing transportation, and food. Some older adults, particularly those with lower incomes, rely on monthly trips to nearby food pantries to bridge the gap between their monthly incomes and expenses. Most housing and transportation expenses are due to the cost of maintenance beyond monthly payments. These trends were especially true for older adults living in lower-income neighborhoods in Indianapolis. Survey data of Central Indiana adults age 60 and older reveals that more than two-fifths (43 percent) report that having enough money to meet daily expenses was at least a minor problem during the previous year, about the same rate as in previous years, with similar difficulties noted statewide. For further discussion of housing, transportation, and food issues for older adults in Central Indiana, see those respective sections of this report.

Inflation and Fixed Incomes

Key informants identified that changes in Medicaid and Supplemental Security Income (SSI) policies have increased the financial instability for older adults relying heavily on fixed income and government assistance programs. When inflation is high, increases in payments tend to lag slightly behind inflation. According to the Social Security Administration, SSI monthly payments will increase to $943 per eligible individual for 2024, a COLA increase of 3.2 percent.38 39 40 For 2023, the Indiana legislature failed to authorize a traditional cost of living adjustment (COLA) increase or “13th check” for state-employed retirees. Instead, legislators formed a study committee to explore a long-term solution not requiring annual legislation.41 42

Employment

Access to technology is often crucial in today’s job market as technology may be required to secure a job, perform job responsibilities, or both. For older adults, particularly those under the age of 85 who have yet to retire or are re-entering the workforce after retirement, gaps in technology skills create a substantial barrier to finding employment, especially for those who previously worked blue-collar jobs. One key informant service provider described the sense of fear that overcomes many older adults when confronted with technology, and their resistance to learning computer skills. This provider estimated that 90 percent of the program’s primarily working-class participants possess few to no computer skills. They may also lack the skills necessary to perform well in jobs. This creates a situation in which older adults increasingly struggle to access employment opportunities which assist with affording basic needs.

A CICOA survey of Central Indiana adults age 60 and older found that in 2021, 35 percent had at least some difficulty finding work while retired, an increase of five percent from 2017.

In Central Indiana, a greater proportion of older adults pay more than 30 percent of their income on housing costs compared to the rest of Indiana.

The oldest old (age 85+) are most likely to be paying more than 30 percent of their income towards housing.

Four out of ten older adults (age 60+) in Central Indiana in 2021 reported some sort of difficulty with meeting daily financial needs.

2-1-1 Calls for Assistance

2-1-1 is a helpline service providing information and referral to health, human, and social service organizations.43 In 2022, for adults age 60 and over in Central Indiana, there were 5,827 total calls, half the number of calls received the previous year. In 2023 (through mid-October) call volume is on track with 2022, with the majority of calls about housing needs, individual/family/community support, and utility assistance. By far the most common request for this age group is electric service payment assistance, almost 15 percent of all calls. The vast majority of these calls, since 2022, are from Marion County (over 90 percent).

- According to the American Community Survey (2019), “total income” includes “wage or salary income; net self-employment income; interest, dividends or net rental or royalty income or income from estates and trusts; Social Security or Railroad Retirement income; Supplemental Security Income (SSI); public assistance or welfare payments; retirement, survivor, or disability pensions; and all other income.”

- An older adult household is defined as a household in which at least one older adult age 55 or older lives.

- Unless otherwise specified, all PUMS data discussed in this report section are five-year estimates, ending in the year mentioned in the text, unless otherwise specified (e.g., ”2021” refers to 2017- 2021 estimates.

- PUMS data is released at the geographic level of PUMA (Public-Use Microdata Area). PUMAs must contain a minimum of 100,000 people and thus vary in geographic size. As a result, when using PUMS data, the Central Indiana region contains Putnam and Brown counties in addition to the eight Central Indiana Community Foundation (CISF) Central Indiana counties of Boone, Hamilton, Hancock, Hendricks, Johnson, Marion, Morgan, and Shelby.

- U.S. Census Bureau, “2017-2021 American Community Survey Five-Year Public Use Microdata Samples.,” https://www.census.gov/programs-surveys/acs/microdata/ac-cess.html.

- Cubanski J, Koma W, Damico A and Neuman T.How Many Seniors Live in Poverty? KFF Issue Brief, November 19, 2018, https://www.kff.org/report-section/how-many-seniors-live-in-poverty-issue-brief/

- Nine focus groups with older adults were conducted during 2019 and 2020 to collect input on issues facing the older adult population in Central Indiana. The focus groups composed of older adults were assembled with the identification and recruitment assistance of community service providers. These focus groups were conducted by researchers, in person prior to the COVID-19 pandemic, and by Zoom after the pandemic began. The questions asked of the focus group participants were discussed and agreed upon by research faculty and staff.

- Thirty-five key informant interviews with caregivers and service providers were conducted during 2019 and 2020 to collect input on issues facing the older adult population in Central Indiana. Public and not-for-profit sector leaders and service providers who are knowledgeable about service systems and issues pertaining to older adults in Central Indiana were identified and inter- viewed as key informants during report preparation.

- U.S. Department of Housing and Urban Development, “Housing Cost Burden Among Housing Choice Voucher Participants | HUD USER,” accessed January 14, 2021, https://www.huduser. gov/portal/pdredge/pdr-edge-research-110617.html.

- U.S. Census Bureau, “American Community Survey, One-Year Average.” Median Earnings.

- Miller S. , Black Workers Still Earn Less than Their White Counterparts. SHRM, June 11, 2020, https://www.shrm.org/resourcesandtools/hr-topics/com-pensation/pages/racial-wage-gaps-persistence-poses-challenge.aspx

- Brooks R. The Retirement Crisis Facing Black Americans.US News Dec 11, 2020. accessed January 28, 2021, https://money.usnews.com/money/retirement/aging/articles/the-retirement-crisis-facing-black-americans

- Old-Age, Survivors, and Disability Insurance. Annual Statistical Supplement 2023. Social Security Office of Retirement and Disability Policy. Accessed Oct 30, 2023 https://www.ssa.gov/policy/docs/statcomps/supplement/2023/5a-expanded.html

- Social Security and People of Color. National Academy of Social Insurance (n.d). accessed January 28, 2021, https://www.nasi.org/learn/socialsecurity/people-of-color.

- Goodman L and Mayer C. Homeownership Is Still Financially Better than Renting. Urban Institute, February 21, 2018, https://www.urban.org/urban-wire/homeowner- ship-still-financially-better-renting.

- Markowitz A. The Racial Retirement Gap in 7 Facts. AARP Oct 18, 2023. Accessed Oct 30, 2023. https://www.aarp.org/retirement/planning-for-retirement/info-2023/racial-savings-wealth-gap.html

- Hillier, A. E. Residential Security Maps and Neighborhood Appraisals: The Home Owners’ Loan Corporation and the Case of Philadelphia. Social Science History. 2005;29(2): 207–233. JSTOR, www.jstor.org/stable/40267873

- Bhutta N, Chang, AC, Dettling LJ, Hsu JW. Disparities in Wealth by Race and Ethnicity in the 2019 Survey of Consumer Finances. FEDS Notes Sept 28, 2020. accessed Oct 30, 2023, https://www.federalreserve.gov/econres/notes/feds-notes/disparities-in-wealth-by-race-and-ethnicity-in-the-2019-survey-of-consumer-finances-20200928.htm

- Polis analysis, based on interactive 2022 Survey of Consumer Finance data at University of California Berkeley, accessed Oct 30, 2023. https://sda.berkeley.edu/sdaweb/analysis/exec?formid=mnf&sdaprog=means&dataset=scfcomb2022&sec508=false&dep=networth&row=race&column=age2&filters=race%281-3%29&weightlist=WGT&main=means&transform=none&percentileopt=median&chartpercentile=on&estimatepercentile=on&cflevel=95&wncases=on&color=on&ch_type=bar&ch_color=yes&ch_width=600&ch_height=400&ch_orientation=vertical&ch_effects=use2D&decmeans=2&dectotals=0&decdiffs=1&decmedian=2&decse=1&decsd=1&decminmax=2&decwn=1&deczstats=2&csvformat=no&csvfilename=means.csv

- Kent A, Lanier N, Perkis DF, James C. Examining Racial Wealth Inequality. Page One Economics March 2022. St Louis Federal Reserve Bank. Accessed Oct 30, 2023 https://research.stlouisfed.org/publications/page1-econ/2022/03/01/examining-racial-wealth-inequality

- Parker A, Wealth Gap: Examining the Root Causes of Poverty among African Americans,” Post and Courier, Dec 28, 2022. Accessed Oct 30, 2023, https://www.postandcourier.com/news/local_state_news/ wealth-gap-examining-the-root-causes-of-poverty-among-african-americans/article_89406f92- e7b0-11ea-894e-73687a88cf63.html

- U.S. Census Bureau, “2017-2021 American Community Survey Five-Year Samples”

- U.S. Census Bureau, “2017-2021 American Community Survey Five-Year Public Use Microdata Samples.”

- Abraham, K, Rendell, L. Where Are the Missing Workers? Brookings Papers on Economic Activity BPEA Conference Drafts, March 30-31, 2023. https://www.brookings.edu/wp-content/uploads/2023/03/BPEA_Spring2023_Abraham-Rendell_unembargoed.pdf

- State of Indiana, Department of Workforce Development data request for 2020-2023.

- 2020 Longitudinal Employer-Household Dynamics Origin-Destination Employment Statistics (LODES, U.S. Census Bureau), https://lehd.ces.census.gov/data/#lodes.

- U.S. Census Bureau, “2017-2021 American Community Survey Five-Year Public Use Microdata Samples.”

- Center on Budget and Policy Priorities. Policy Basics: Supplemental Security Income., Feb 21, 2023, https://www.cbpp.org/research/social-security/policy-basics-supplemental-security-in-come.

- U.S. Census Bureau, “2017-2021 American Community Survey Five-Year Public Use Microdata Samples.”

- United Way of Northern New Jersey. ALICE Research Center: Indiana.” 2020, https://www.unit- edforalice.org/ ndiana.

- U.S. Department of Housing and Urban Development, “Housing Cost Burden Among Housing Choice Voucher Participants | HUD USER.”

- U.S. Census Bureau, “2017-2021 American Community Survey Five-Year Public Use Microdata Samples.”

- National Research Center, “CICOA Aging and In-Home Solutions Full Report,” Community Assessment Survey for Older Adults ™ (Boulder, CO: National Research Center, 2013).

- National Research Center, “CICOA Aging and In-Home Solutions Full Report,” Community As sessment Survey for Older Adu™(TM) (Boulder, CO: National Research Center, 2017).

- National Research Center, “CICOA Aging and In-Home Solutions Full Report,” Community As sessment Survey for Older Adults (TM) (Boulder, CO: National Research Center, 2021).

- Digital Communications Division (DCD). Who Is Eligible for Medicare? Text, HHS.gov, June 7, 2015, https://www.hhs.gov/answers/medicare-and-medicaid/who-is-elibible-for-medicare/index. html

- Gross income is a person or household’s total income, while net income is gross income less taxes and deductions.

- U.S. Social Security Administration. Social Security Benefits Increase in 2024. accessed October 26, 2023 https://blog.ssa.gov/social-security-benefits-increase-in-2024.

- Social Security Administration. SSI Federal Payment Amounts. accessed Oct 26, 2023, https://www.ssa.gov/oact/COLA/SSIamts.html

- Social Security Administration. Average CPI By Quarter And Year. accessed Oct 26, 2023, https://www.ssa.gov/oact/STATS/avgcpi.html

- Indiana Capital Chronicle. No COLA or 13th check for Indiana retirees. May 2, 2023. Accessed Oct 26, 2023. https://indianacapitalchronicle.com/2023/05/02/no-cola-or-13th-check-for-indiana-retirees/

- Indiana Capital Chronicle. Pensions panel recommends guaranteed 13th check-COLA split. Oct 25, 2023. Accessed Oct 26, 2023 https://indianacapitalchronicle.com/2023/10/25/pensions-panel-recommends-guaranteed-13th-check-cola-split/

- Indiana 2-1-1 Needs Data. n.d. Indiana 2-1-1 data analysis is provided by SAVI Community Information System. 2-1-1 is a free and confidential service that helps Hoosiers across Indiana find the local resources they need. When a client calls 2-1-1 for help, this is referred to as an interaction. During each interaction, a client may communicate one or more needs, related to a single problem or multiple problems. When a call is received by 2-1-1, it is placed in one or more categories, depending on the nature of the need(s) expressed by the caller. For example, if a caller requests a referral for a food pantry, a referral for transportation to help get to that pantry, a referral for donated clothing, and a referral for a soup kitchen, the call is identified as a single, unique call related to food needs, transportation needs and material assistance needs. Even though there are two different food-related needs expressed, the call is only counted as a single call for food-related help. https://in211.communityos.org/datadashboard Accessed Oct 27, 2023